Popular Economics Weekly

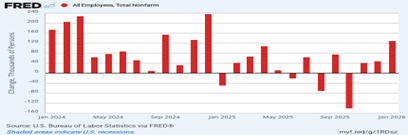

“From the preceding month, the PCE price index for December increased 0.4 percent. Excluding food and energy, the PCE price index also increased 0.4 percent.

From the same month one year ago, the PCE price index for December increased 2.9 percent. Excluding food and energy, the PCE price index increased 3.0 percent from one year ago.” BEA.gov

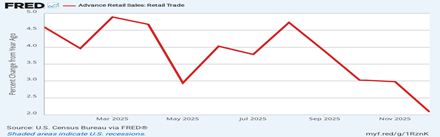

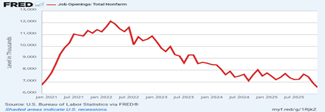

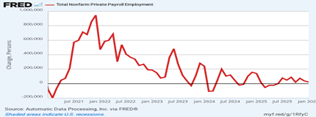

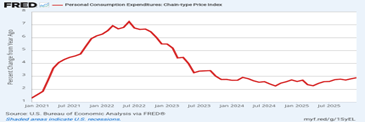

The inflation contagion is preceding unabated, per the FRED graph of the Personal Consumption Expenditure Index, the favored Federal Reserve inflation indicator.

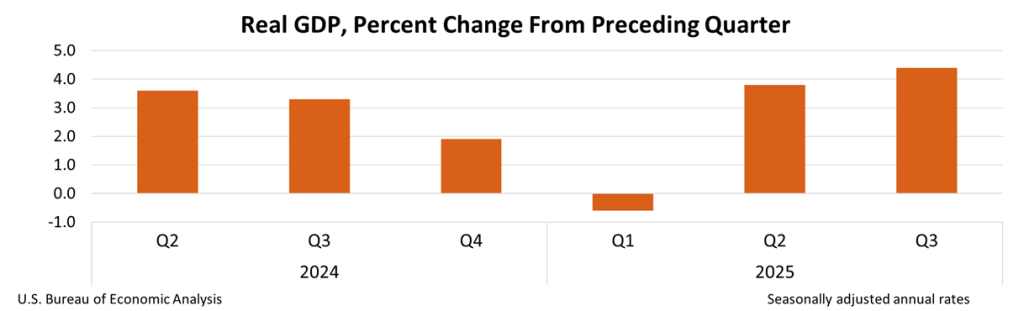

Why? Because little to nothing has been done about inflation, although that may change with the Supreme Court’s decision to outlaw Trump’s executive orders allowing retaliatory tariffs. The evidence is that tariffs have raised prices and done nothing to lower the trade deficit that Trump has railed about, per Paul Krugman’s Substack blog.

The Fed uses the PCE index because it most broadly measures the change in goods and services prices of goods consumed “by all households, and nonprofit institutions serving households”, says the Bureau of Labor Statistics (BLS).

It is a virus-like contagion indicator because consumers can’t do much about it over the short term other than shop for more bargains. It’s caused by product shortages and Trump’s tariffs, disruptions due to Trump’s continuous changes to tariffs that percolate through the general economy.

The FRED above graph also shows that President Biden had already brought PCE inflation down to 3% in October 2023. It has remained there ever since, only beginning to creep up after Trump’s April 2025 Liberation Day tariff announcements.

And it continues its creep, which will make the Fed’s decision about when to lower interest rates more difficult. Consumers are also becoming increasingly anxious about inflation.

And minutes of the Federal Reserve’s first meeting of the new year showed that several officials wanted the central bank to report there was a chance its next move might be to raise interest rates because of the stubborn inflation data.

The Conference Board’s Confidence Index also measures such attitudes: “Consumers’ write-in responses on factors affecting the economy continued to skew towards pessimism. Comments about prices, inflation, and the cost of goods remained at the top of consumer’s minds.”

Why is inflation so contagious, to use the virus analogy? Because price changes are connected, they ‘infect’ each other as every consumer and business knows. For instance a rise in import prices raises the price of the final product, whatever it is.

Economists call the phenomenon inflation expectations. Research has shown if businesses expect high inflation, they may raise prices immediately; if workers expect it, they will demand higher wages, creating a self-fulfilling prophecy.

It’s all about attempting to predict future behavior, in other words. Consumer confidence surveys, such as the Conference Board’s Consumer Confidence Index attempt to measure inflation expectations, for instance:

“Consumers’ average and median 12-month inflation expectations were little changed but remained elevated. Consumers also believed that interest rates will persist at higher levels over the next 12 months.

The good news is that even Independent voters are seeing through the propaganda and blatant lies that lay behind President Trump’s “Day One” promises.

Harlan Green © 2026

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen