The Mortgage Corner

How high can housing prices go? They rose in double digits annually in the early 2000s during the housing bubble. But that was when the housing supply could not keep up with the demand for housing, and interest rates were low, a demand inflated by so-called ‘liar’ loans requiring no verification of income.

Housing is one of society’s basic needs, along with food and clothing. So we must pay attention to what happens to housing if we want a functioning democracy.

Demand for housing isn’t being inflated by loose credit conditions today, but housing construction hasn’t kept up with demand since the housing bubble for a number of reasons, including the pandemic.

The result is housing prices are rising fast again in states like California with its rising homeless population.

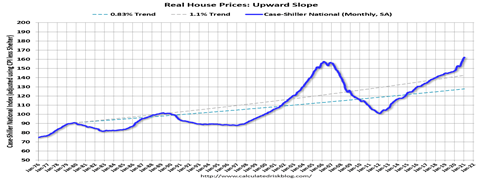

The Calculated Risk graph dating from 1976 shows the various price bubbles in the 1970s, 80s, 2007 housing bubble, and today. It shows prices rising again at almost the same clip as during the housing bubble.

A federal judge overseeing a sprawling lawsuit about homelessness in Los Angeles has even ordered the city and county Tuesday to offer some form of shelter or housing to the entire homeless population of skid row by October, according to the LA Times.

In the last homeless count in January 2020, more than 4,600 unhoused people were found to be living on skid row — about 2,500 in large shelters and 2,093 on the streets, according to the LA Times. They account for only slightly more than 10% of the city’s overall homeless population, and it’s not clear what presiding Judge Carter’s order might mean for other parts of the city.

America’s lack of adequate housing has reached crisis levels, in other words, with so many losing their homes and livelihoods during and the pandemic.

It is the reason some $213 billion of the American Jobs Act is being allotted “to produce, preserve, and retrofit more than two million affordable and sustainable places to live.”

The While House website says it pairs this investment with “an innovative new approach to eliminate state and local exclusionary zoning laws, which drive up the cost of construction and keep families from moving to neighborhoods with more opportunities for them and their kids.”

It will also help address the growing cost of rent and create jobs that pay prevailing wages, including through project labor agreements with a free and fair choice to join a union and bargain collectively.

The reasons for our housing crisis are too many to list at once. It has as much to do with income inequality as with NIMBY exclusionary zoning regulations that segregate communities.

It also has to do with our outmoded infrastructure that lacks improved roads, bridges, and mass transit systems to get to and from work centers. So outlying communities become detached from inner cities, creating high-priced gentrified ghettos.

Housing construction and sales have been the first to rally after the pandemic. Demand is so hot that the median existing-home sales price rose to $303,900, 14.1 percent higher from one year ago, I said in January. And as of the end of January, existing-home inventory fell to a record-low of 1.04 million units, down by 25.7 percent year-over-year – a record decline.

Total existing-home sales,1 https://www.nar.realtor/existing-home-sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.6% from January to a seasonally-adjusted annual rate of 6.22 million in February. Sales in total climbed year-over-year, up 9.1% from a year ago (5.70 million in February 2020).

“Despite the drop in home sales for February – which I would attribute to historically-low inventory – the market is still outperforming pre-pandemic levels,” said Lawrence Yun, NAR’s chief economist.

And now the US Census Bureau is saying privately-owned housing starts (construction) in March were at a seasonally adjusted annual rate of 1,739,000. This is 19.4 percent (±13.7 percent) above the revised February estimate of 1,457,000 and is 37.0 percent (±15.2 percent) above the March 2020 rate of 1,269,000.

That is a return to boom times for homeowners and buyers, but not for renters and the growing homeless population.

So governments, and the legal system in some cases, must step in to care for those that private industry cannot—since our general welfare is as important for a healthy democracy.

Harlan Green © 2020

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen