Should home buyers worry about the record-low interest rates in the near or distant future?

Because interest rates are at post-World War II lows, the super cheap money is helping to drive up annual home price rates into double digits, resulting in a loss of affordability for many prospective homebuyers and even renters.

And the Federal Reserve is reluctant to raise interest rates, fearing it will collapse the recovery with COVID variants not yet vanquished.

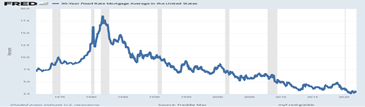

The 30-year conforming fixed mortgage rate favored by most home buyers has been declining since the early 1980s, and has hovered around 3 percent since the start of the pandemic, per the above Federal Reserve Bank of St. Louis (FRED) graph.

It is a major reason the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index of single-family, same home, price changes reported a 19.5 percent annual gain in September 2021, though slightly down from 19.8 percent in August. The S&P Index is a 3-month average for 20 metropolitan areas, so in some cities home prices are rising even faster.

“It’s unprecedented for us to get a massive run-up in home prices during a recession,” says Freddie Mac’s chief economist, Sam Khater. “It’s clear that [mortgage] rates matter even more than unemployment rates.”

Another reason for the price run-up is that inflation is soaring as well. The retail Consumer Price Index, seen below in the 2nd FRED graph, is up 6.8 percent in November Y-o-Y when it has averaged just 2 percent since the Great Recession.

And if said inflation remains much higher than interest rates (3 percent vs. 6.8 percent inflation), it means in effect negative interest rates since higher inflation reduces the value of the loan principal over time. And that pours gas on the exploding home prices.

This is not an easy concept to understand, but it happened during the housing bubble when housing prices were also rising in the double digits annually.

Soaring inflation is the other problem, and that probably won’t decline until the labor and supply-chain shortages subside sometime next year.

So should home buyers wait for this housing price bubble to subside to buy a home? The National Association of Realtors hasn’t much helping advice.

“Home sales remain resilient, despite low inventory and increasing affordability challenges,” said Lawrence Yun, NAR’s chief economist. “Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

Is there any good news? The Federal Reserve released the Q3 2021 Flow of Funds report on Thursday: Financial Accounts of the United States. It stated that American households’ net worth is at a record high as a percentage of GDP (more than 600 percent of GDP), increasing $2.3 trillion in Q3, thanks to government spending for the COVID pandemic that is approaching $5 trillion to date with more to come when the Build Back Better Act finally passes.

MarketWatch’s Steve Goldstein cites James Knightley, chief international economist at ING, who put a positive spin on the latest report. From the low point of the first quarter of 2020, household wealth has surged by $35.5 trillion. Combine this wealth rise with employment growth, and wage gains, and the U.S. consumer looks to be in good shape.

The “further massive accumulation of wealth only adds to the potential spending ammunition of the household sector, which gives us more confidence that the U.S. economy can expand by more than 4% in 2022,” says Knightley.

But there’s still a housing shortage that some economists predict could last 10 years. So this has happened before, and only a concerted effort of governments and builders will lessen the housing crunch we are currently experiencing.

Harlan Green © 2021

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen