Job growth is slowing, but is it enough to call off the inflation hawks, including Federal Reserve Governors, from wanting more rate hikes?

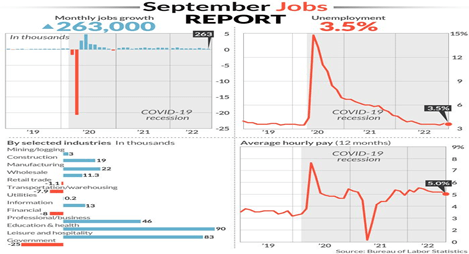

The U.S. Economy is still fully employed for those wanting to work; with a historically low 3.5 percent unemployment rate, 263,000 nonfarm payroll jobs, and hourly wages rising at 5 percent in September’s unemployment report.

It was the smallest jobs gain in 17 months, and we are back to pre-pandemic levels of employment, but inflation is still high because of the Ukraine War and a shortage of goods and services. The so-called supply-chain shortages really mean there is still a worldwide supply shortage, though now there are now plenty of trucks, ships, and planes to deliver them.

Almost all business sectors continued hiring, and people continued to travel and dine out in large numbers, as hotel, restaurants and other companies in the hospitality business created 83,000 new jobs, reflecting strong demand for services such as travel and recreation.

Hiring also rose sharply in health care and professional businesses. Manufacturers added 22,000 jobs and construction firms hired 19,000 people.

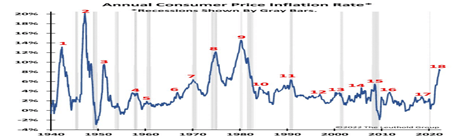

All this activity is keeping prices from falling fast enough to please the hawks, but do we even have much choice in the matter? Noted market strategist Jim Paulsen of the Leuthold Group has done research on the history of such inflationary spikes, and they all pretty much behave the same, regardless of monetary policy.

His graph shows that inflation spikes have come down as fast as they rose. Paulsen maintains this is therefore an excellent buying opportunity for investors because it’s now possible to predict approximately when the inflation surge ends and interest rates decline, which tend to follow inflation trends.

An inflation cycle usually takes approximately 12 months from its beginning to end, so since this inflation spike began in April-May, we should see inflation returning to a normal range by next April-May.

And he sees inflation already subsiding:

- CL.1, 3.36% are down 30% from June. A gallon of gasoline has fallen 23% since peaking in the same month. Energy is central to the economy, so its price has a big impact on the prices of almost everything. Plus, there is a psychological angle.

- CSGP, -1.89%, a great source of data on real estate trends and analytics. “We’re seeing a complete reversal of market conditions in just 12 months, going from demand significantly outstripping available units to new deliveries outpacing lackluster demand,” says Jay Lybik, CoStar’s director of multifamily analytics.

- TGT, -1.96% grabbed headlines in early June when it reported it will have to cut prices to clear inventories. Nike NKE, -2.27% followed suit last week. Those two are not alone in over-ordering merchandise, expecting the pandemic-induced consumer preference for goods over services to continue. This inventory clearing will show up in headline inflation numbers soon.

And consumer surveys already show consumers becoming more confident about the future with inflation expections now below 3 percent over the next five years.

This should be enough to convince inflation hawks to ease up on their inflation fears, amd the Fed to pause and see what the holdays bring. Consumers and businesses seem to be tolerating the moderate Fed rate hikes to date. And there’s no hurry to reverse course, unless prices begin more dramatic declines leading to disinflation, or outright deflation. Why not show patience, Fed Chairman Powell, as consumers seem to be doing and enjoy the holidays!

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen