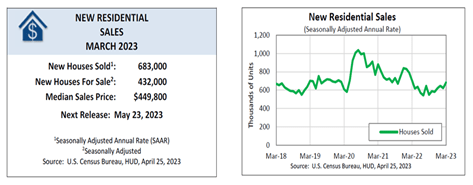

Sales of new single‐family houses in March 2023 were at a seasonally adjusted annual rate of 683,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 9.6 percent (±15.2 percent)* above the revised February rate of 623,000, but is 3.4 percent (±12.7 percent)* below the March 2022 estimate of 707,000. The seasonally‐adjusted estimate of new houses for sale at the end of March was 432,000. This represents a supply of 7.6 months at the current sales rate.

That and rising homebuilder’s optimism foretells a strong summer sales season. And it could also mean no imminent recession, since rising sales are largely because mortgage rates have fallen roughly one-half percent.

Builders remained cautiously optimistic in April, as limited resale inventory helped to increase demand in the new home market. Single-family builder confidence in April rose one point to 45, according to the NAHB/Wells Fargo Housing Market Index.

Currently, one-third of housing inventory is new construction, compared to historical norms of around 10%. More buyers looking at new homes, along with the use of sales incentives, have supported new home sales since the start of 2023. Builders note that additional declines in mortgage rates (to below 6%) will further boost demand.

“A lack of resale inventory combined with many builders offering price incentives helped to push new home sales higher in March,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a builder and developer from Birmingham, Ala. “However, sales are down 3.4% compared to a year ago because of the shortage of electrical transformer equipment and building material price volatility.”

“The months of supply decreased in March to 7.6 months from 8.4 months in February,” says Calculated Risk’s Bill McBride. “The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.”

And the 30-year conforming fixed rate is still obtainable at 5.75 percent for one origination point in California.

Estimates of first quarter 2023 GDP growth are all over the map, from 0.0 to 2.0 percent. The first estimate comes out this Thursday, which will tell us whether Q1 starts out this year on a positive note.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen