Realtors are loudly crying that holding interest rates at the current high level for a prolonged period is destroying the housing market., I said recently. Existing-home sales are now at the lowest level since the Great Recession, and the danger is a serious housing downturn could lead to another recession.

It has prompted NAR chief economist Lawrence Yun to say, “As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales. The Federal Reserve simply cannot keep raising interest rates in light of softening inflation and weakening job gains.”

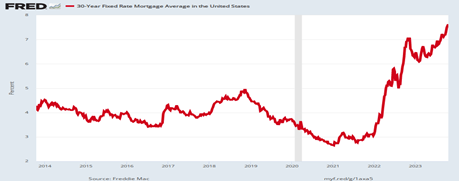

Why is he so concerned? The 10-year benchmark Treasury yield that determines fixed mortgage rates has just breached 5 percent for the first time since July 2007, causing mortgage rates to soar.

This last happened in the lead up to the busted housing bubble and Great Recession of 2007-2009.

Alan Greenspan’s Federal Reserve at the time had raised their Fed Funds rate to 5.25 percent on August 2006 and held it to June 2007 before easing credit conditions. The Great Recession was determined to have begun in December 2007. There is not as much danger of it happening today because bank reforms have made financial markets more wary, yet past housing market downturns have been predictive of past recessions.

The same confluence of high mortgage rates with the Fed Funds rate is in danger of happening again today, only much more quickly as the real estate market has shrunk drastically during the Fed’s current tightening cycle.

According to Freddie Mac, the 30-year fixed rate mortgage averaged 7.57 percent as of October 12 (see above FRED graph). That’s up from 7.49 percent the previous week and 6.92 percent one year ago.

Existing-home sales fell even lower in September, according to the National Association of REALTORS®. Among the four major U.S. regions, sales rose in the Northeast but receded in the Midwest, South and West. All four regions registered year-over-year sales declines.

Total existing-home sales1 – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.0% from August to a seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022), said the NAR.

Single-family home sales slipped to a seasonally adjusted annual rate of 3.53 million in September, down 1.9% from 3.6 million in August and 15.8% from the prior year. The median existing single-family home price was $399,200 in September, up 2.5% from September 2022, said the National Association of Realtors (NAR).

Such a mortgage rate has made housing even less affordable for first-time home buyers. First-time buyers were responsible for 27% of sales in September, down from 29% in August 2023 and September 2022, and pre-pandemic levels closer to 40 percent.

NAR’s 2022 Profile of Home Buyers and Sellers – released in November 2022 – found that the annual share of first-time buyers was 26%, the lowest since NAR began tracking the data.

A record number of multi-family units (apartments) are under construction, as there are now a record number of Americans needing some kind of housing, and more apartments might create more affordable rents.

But it won’t satisfy those still holding the American dream of owning their own home, I said last week. “For the third straight month, home prices are up from a year ago, confirming the pressing need for more housing supply,” Yun said.

Have the Fed Governors learned from their actions leading to the Great Recession? They again reached the 5.25 percent rate recently after raising their interest rate for more than one year. The question will be how long they dare to keep it so high without causing another recession.

Long-term interest rates may stay high because of the unusual flood of Treasury securities on the market that is financing a new industrial resurgence and the need for higher military spending.

But there’s no need for the Fed to continue to restrict credit with inflation in decline. We need higher economic growth more than ever with so much geopolitical uncertainty, and a poor housing market.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen