This is what is called a ‘soft landing’. More jobs are being created in November’s unemployment report, though some 50,000 of the 199,000 new nonfarm payroll jobs are strikers returning to work in Hollywood productions and auto factories

And they got terrific raises. Yet average hourly pay fell to 4.0 percent, which should please the Fed. How can that be? Because workers are producing more in less time with labor productivity now soaring.

Unit labor costs (i.e., wages) fell at a 1.2 percent annualized rate in the third quarter, I reported recently. Unit labor costs rose at a 1.6 percent rate from a year ago, the smallest year-on-year increase since the second quarter of 2021.

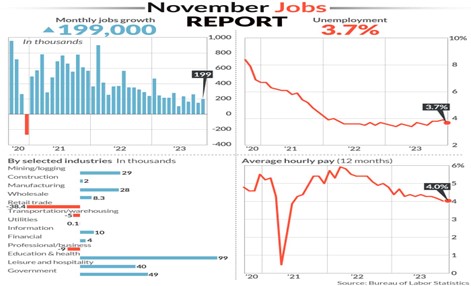

“Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.”

The unemployment rate fell from 3.9 percent to 3.7 percent because half a million new workers entered the workforce. Education, Leisure/Hospitality, and Government added 188,000 of those new hires. The mining and manufacturing sectors added an additional 57,000 jobs.

This is the best of all worlds for the American economy. The share of the population working or looking for work even matched a post pandemic high of 62.8 percent.

Another sign of a soft landing was that consumer spending has slowed, which puts less pressure on prices, and so a reason that the inflation rate continues to decline.

Total consumer credit rose $5.2 billion in October, down from a $12.2 billion gain in the prior month, the Federal Reserve said Thursday. That translates into credit growth in both credit cards and installment loans at a 1.2 percent annual rate, down from a 3 percent rate in the prior month. Revolving credit (cards) increased at an annual rate of 2.7 percent, while nonrevolving credit (installment loans) increased at an annual rate of 0.7 percent.

I reported last week that Paul Krugman in a recent NYTimes Op-ed said the personal consumption expenditure deflator (PCE) excluding food and energy—the Fed’s preferred inflation indicator—has risen at an annual rate of just 2.5 percent over the past six months, down from 5.7 percent in March 2022. When food and energy prices are added it still rose just 2.5 percent.

More Americans want to work because of higher pay and it’s easy to find a job, so miracle of miracles, and congratulations to Fed officials, we have achieved a soft landing in time for the holidays and a more hopeful New Year.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen