Financial FAQs

“Retail trade sales were virtually unchanged (±0.5 percent)* from November 2025, and up 2.1 percent (±0.5 percent) from last year. Nonstore retailers were up 5.3 percent (±1.4 percent) from last year, while food service and drinking places were up 4.7 percent (±1.8 percent) from December 2024.” Census Bureau

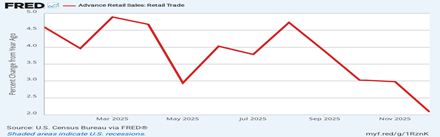

This FRED graph shows best what tariffs have done to consumer spending, which powers 70 percent of economic activity, let us not forget. Retail sales fizzled in December as I feared would happen in my November retail report, rising just 2.1 percent annually. And retail sales don’t take inflation into account, so consumers weren’t keeping up with the rising prices.

Sales had declined or were barely positive in six of 11 months through November 2025, I said then. So why wouldn’t consumers turn even more cautious with almost no new payroll jobs. The latest Labor Department JOLTS report showed that as many people were leaving jobs as were hired—so zero net new jobs were added to the workforce, in other words.

This means the economy is steadily shrinking for most Americans because of the disastrous and largely ineffectual tariff policies that have increased import taxes, therefore higher inflation, the opposite of Trump’s promise to bring down prices on ‘Day One”.

The FRED graph shows just how consumers timed their purchases with the tariffs. Sales had plunged in May when the April 2 retaliatory tariffs were announced on all 180 countries in the world, some mostly inhabited by birds. Then Trump’s TACO tactics kicked in postponing them for 60 days, then raising them again when countries refused to meet his deadline for deals.

Also, November was the last month consumers splurged for the holidays so annual sales dropped from 3.1 percent to just 2.1 percent in just one month, when annual retail sales usually increase from 3-6 percent in good times.

My guess is that the AI build out of new energy centers won’t help inflation for a long time, if ever, or create many jobs in the near future, So Trump is saying we must lower interest rates to boost some growth and keep consumers happy. But inflation may not behave since concentrating so much wealth in AI investment with little return to show for it in the near term, may raise inflation.

Or, what will consumers ultimately do if Trump can’t stop playing the tariff game in his attempt to twist arms to achieve his ultimate goal of dominating friends and neighbors rather than cooperating with them?

The Trumper bet is that this year will bring more consumer benefits with the Fed’s new Chairman in May wanting to push interest rates lower as well as the tax breaks in Repub’s Big Beautiful Tax Bill.

In Nobel economist Paul Krugman’s words, “So am I saying that the argument that AI justifies rate cuts is dishonest, that AI has become the last refuge of scoundrels? Why yes, I am.”

So what could go wrong?

Harlan Green © 2026

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen