Financial FAQs

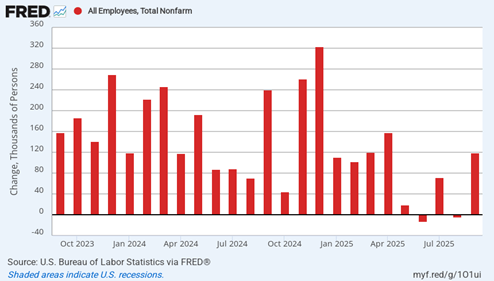

“Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment. And while November’s slowdown was broad-based, it was led by a pullback among small businesses.” ADP

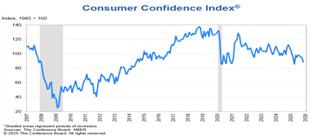

We know why consumer confidence has plunged to a new post-pandemic low. We have no news of current economic conditions to guide consumers and investors, much less what may happen next, so the U.S. economy is still flying blind.

The November unemployment report comes out on December 16, for instance, (skipping October’s report) after the Fed’s FOMC meet that decides whether another rate cut is appropriate, so we have only the ‘unofficial’ ADP private payrolls report on employment that showed -32,000 private payrolls were lost in November.

The goods sector of the U.S. economy, including Construction and Manufacturing, lost -19,000 jobs. The service sector lost -12,000 overall, though Education, Health and Leisure activities added +46,000 jobs in the sector.

September’s last ‘official’ unemployment report with 119,000 payroll jobs was ok, but that was before the government lock down. And the U.S. economy had averaged just 38,600 new jobs since April and the tariff announcements.

Dr. Nela Richardson Chief Economist, ADP said it best in the survey. Small businesses aren’t hiring because of the uncertain tariffs, since some 90 percent of small businesses import their products that are sold in the U.S.

September retail sales also reported before the shutdown. Retail sales are growing more dependent on a smaller group of consumers. The top 10% of earners in the U.S. accounted for nearly 50% of spending in the second quarter, the highest level it’s been since this data first started being collected in 1989, according to Moody’s Analytics.

And the poor ISM manufacturing index numbers show the manufacturing sector has been contracting for the past nine months.

“A closely followed manufacturing index fell to a four-month low of 48.2% in November from 48.7% in the prior month, the Institute for Supply Management said Monday. Any number below 50% signals contraction,.” MarketWatch

The Federal Reserve will probably lower interest rates another -0.25%, but next year is a rate tossup because of the inflation worries, as almost no tariff agreements have been ratified by congress and signed.

We still have a lot of postponed economic data from the government shutdown, in other words, such as personal consumption and spending data (PCE) that the Fed prefers to measure inflation. We know that annual consumer CPI inflation had jumped to 3% in September, also before the shutdown, and will probably go higher as the tariff costs are passed on to consumers and businesses.

It’s obvious that we are living in uncertain times, and the old Republican playbook of tax cuts combined with DOGE and Project 25 slashing of government benefits are hurting the 90 percent of Americans still living paycheck to paycheck, as I’ve said.

Is that enough to cause a recession, in spite of the stock market’s boost supporting the top 10 percent of Americans that can still afford more than the basic necessities?

It won’t take much to tip US into a recession. The data we need to predict the future will eventually come out. Then we will know if not only the manufacturing sector is contracting—e.g., employment, capital expenditures, and incomes—which are the other major components that determine whether we are in a recession.

Harlan Green © 2025

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen